Repossessed houses offer certain benefits for investors and home buyers. In this article, we discuss 5 advantages for people who are searching for ‘repo houses for sale near me.’

What are repossessed houses?

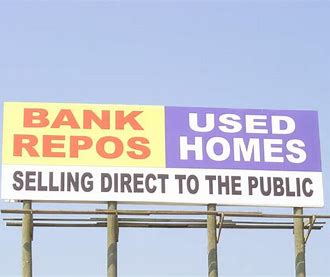

When the debtors to the bank fail to honor their financial commitments, the bank takes legal action against them and, at times, asks the court to auction the houses of their debtors. If the bids at the auction are less than the outstanding receivables of the bank, the bank has a right to purchase this property at the auction. After this purchase, the bank would either choose to sell these properties or rent them back to their previous owners. Such houses are classified as repossessed houses. These houses are directly advertised for sale by the banks, or at times the bank would share the list of repo homes with real estate agents or companies.

5 Advantages of Buying Repossessed Houses

There are a lot of advantages to purchasing repo homes. Five most important ones are listed below:

- Steal of a deal: Buyers can find a great deal on repo homes as the banks are not interested in making a profit from the sale of these homes. They are just looking to recoup their outstanding mortgage balances. Many times, the outstanding debt is less than the fair market value of the homes. In such cases, the asking price of the banks can be fairly low.

- Ready to move in: Before the house is put for auction, the lender would ensure that the property is vacated and is empty. So, the house would be ready to move in upon purchase. In cases where the house has been on the market for a long time due to its bad condition, the bank might make the necessary repairs and renovations before listing it.

- No additional liability or title concerns: The outstanding municipal debts on the repo homes will be taken care of by the banks. Thus, the new owner would not have to worry about additional municipal liabilities as soon as they purchase the house. All the other arrears in taxes and payments would also be settled by the bank, making it easier for the investors and buyers. If you buy a home directly from the previous homeowner, there might be concerns about getting a clean title on the house. There is no such issue in buying a repo home as the bank takes care of such legalities.

- Easier Home Loan Approvals: As banks are in a hurry to recoup their losses, they sometimes relax their lending criteria. If someone is interested in purchasing the home by taking a loan from their bank, they may ignore a few minor shortcomings in the buyer’s eligibility for the loan.

- Other Financial Aspects: In many places, you don’t have to pay transfer tax, known as Documentary Stamp Tax in Florida, on repo homes. Also, since mostly all repo homes are vacant, the investor has more flexibility to make decisions. For example, if one is planning on renting out the unit, they don’t have to wait till the previous occupants vacate the home, giving them the advantage of starting their rental income as soon as they invest. A fair deal, cost savings, and quick possession can significantly help in improving the Return on Investment when buying repossessed houses.

If you are searching for ‘repo houses for sale near me,’ there are also other ways to buy a home at a great price. Visit Tropic Coast Homes for the best properties and deals on the market.